By KoS, via Wikimedia Commons

Consumers be forewarned! The price of your cotton clothes will rise!! Brands, retailers and suppliers are doing everything they can to keep costs down but they are in “a no-choice situation”, “prices have to come up.”

Cotton futures increased to around $1.4 recently; the highest price measured in 140 years of trade and with inventories at an all time low, there’s been some massive panic in the apparel industry. Other than the increase in cotton clothing costs, there are a variety of other consequences:

1. It’s expected that in an attempt to cut costs, producers, brands and retailers will probably increase the use of cotton blends and synthetics in their lines.

2. Component materials like thread and buttons are also being examined for cost savings.

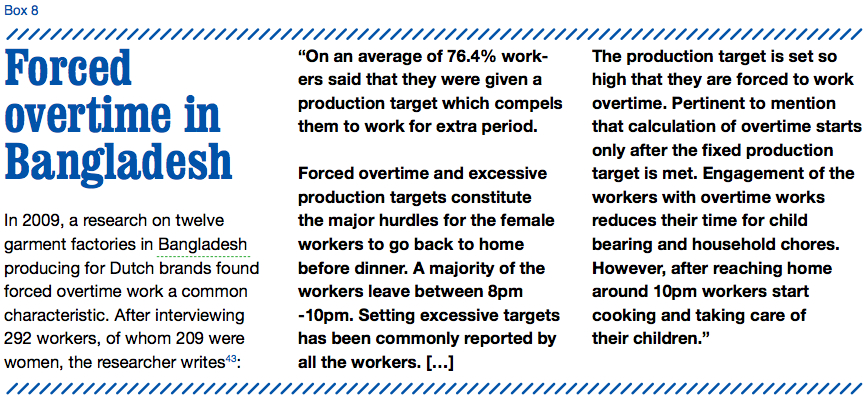

3. Many companies (sticking with tradition) are placing their orders with manufacturers in lower wage and lower duty tariff countries like Bangladesh, and Cambodia; both of which experienced massive garment labour unrest over their workplace conditions.

So how did this situation arise?

Cotton LifeStyle Monitor explained the situation and concluded that this is a “classic situation in which prices are bound to rise” and that “[i]t may be helpful to recognize the forces that coincided to produce this “perfect storm” and to understand that cyclical events correct themselves over time.“

Okay then, let me try:

1. The financial crisis: lagging consumer demand was met by a decrease in supply but when consumer demand rebounded slightly, supply hadn’t caught up which put a lot of pressure on inventories that were already low because of the low consumer demand that we started with.

2. Bad weather in… pretty much every place where there is cotton production…floods in Pakistan, droughts in China, Australia and Russia. This means that supply will continue to be low for a while and inventories will not be restocked i.e. shortages in cotton.

3. Speculators saw these factors as good indicators of potential increases in cotton prices and entered the cotton market (i.e. bought it all up) and drove prices even higher by further increasing demand .

Interesting how volatile the cotton market has been this year! You know what The Daily Show has to say about the “perfect storm”:

“So it was the perfect storm…I feel like I’ve heard that before….The GM Bailout? The 2007 Bubble? The 2008 AIG bailout? Just a random crappy day on Wall Street?

Why is it that when something happens that the people who should’ve seen it coming didn’t see it coming, it’s blamed on these rare-once-in-a-century perfect storms, that for some reason take place every f***ing two weeks?

I’m beginning to think these are not perfect storms. I’m beginning to think these are regular storms and we have a shitty boat”.

(here’s a link to the clip for our Canadian friends)

Given the volatility of the cotton market, what can a company do to prevent price fluctuations?? One thing that brands, retailers and suppliers can do is learn from other industries dependent on volatile commodities. Two classic examples are coffee and cocoa.

Coffee

As you can see from the graph below, the coffee market is incredibly volatile.

Trends and variability in international coffee prices (annual averages) (FAO, 2003)

The FAO Commodity Market Review for 2003-2004 concluded a chapter on lessons learned from the international coffee crisis with this statement:

“Ultimately, non-competitive producers must diversify out of coffee production.”

The Starbucks 2003 CSR report was very frank about the consequences of this price volatility:

“A fair price to a Guatemalan coffee farmer living in a small, remote village may be different than that of a farmer living in Kenya. But in the end, both farmers must earn enough to cover their costs of production and adequately support their families. Otherwise, they may stop growing coffee.“ (emphasis added)

So, to insure a sustainable and stable supply of coffee in the future, Starbucks, the world’s largest buyer of coffee, with the help of Conservation International, developed Coffee and Farmer Equity Practices (C.A.F.E.), a set of guidelines and measurable standards designed to help farmers engage in socially and environmentally responsible agriculture. They have also increased their purchases of fair trade certified coffee making it the largest purchaser in that market as well. By 2015, Starbucks aims to source 100% of their coffee from responsibly grown and ethically traded sources which they define as “third-party verified or certified, either through Coffee and Farmer Equity (C.A.F.E.) Practices, Fairtrade, or another externally audited system.”

Cocoa

The cocoa industry faced a similar situation as the coffee industry with a highly volatile market. An FAO report described price changes from 2000-2005:

By Medicaster, via Wikimedia Commons

In 2009, Mars announced their aims to have a completely sustainable cocoa supply chain by 2020 and is working with the Rainforest Alliance and UTZ Certified to reach this goal. It is the first chocolate retailer to do so and when asked the reasons behind the decision the response is remarkably similar to that of Starbucks:

“It is the appropriate choice for a stable, high-quality cocoa supply in the future”.

According to the Washington Post, the move is part of a long-term strategy to deal with fluctuating supplies which includes “a five-year, $10 million project to map the entire cocoa genome with the aim of developing trees that can better survive drought and disease.”

For both industries, large players realized that the long term consequences of price volatility include an unstable and shrinking supply. The response was to develop a strategy that included a long term investment in the environmental and social sustainability of farming communities. This investment should pay back as a sustainable, stable and consistently priced raw material central to the survival of these companies.

Cotton faces the same conditions as both coffee and cocoa in terms of price volatility and demand-supply fluctuations. I think it might be time for the big players in the apparel industry to talk to the big players in the coffee and cocoa industries. The only similar initiative I know of in the apparel industry is H&M’s commitment to sustainable materials.